Here are the top Infra stocks in India along with their key details:

1. Larsen & Toubro (L&T)

Overview:

Larsen & Toubro is a diversified conglomerate with a strong presence in engineering, construction, manufacturing, technology, and financial services. Its infrastructure segment is a significant revenue driver.

Headquarters:

Mumbai, Maharashtra

Services:

- Engineering and construction

- Manufacturing

- Technology services

- Financial services

Stock Potential:

L&T’s diversified portfolio, robust order book, and strategic expansion into renewable energy and digital infrastructure make it a strong candidate for long-term growth.

Market Price (As of June 2024):

₹2,500 per share

Cost Profit Potential:

L&T’s consistent performance and involvement in high-value government projects position it for steady returns. Investors could expect annual returns in the range of 12-15% over the next six years.

2. Adani Ports and Special Economic Zone (APSEZ)

Overview:

Adani Ports is India’s largest private multi-port operator, with a presence across the country, handling a substantial portion of India’s cargo.

Headquarters:

Ahmedabad, Gujarat

Services:

- Port operations

- Logistics

- Special Economic Zone development

Stock Potential:

With aggressive expansion plans, strategic acquisitions, and increasing trade volumes, APSEZ is well-positioned for significant growth.

Market Price (As of June 2024):

₹750 per share

Cost Profit Potential:

Given its dominant market position and expansion into new ports and logistics services, APSEZ could offer annual returns of 15-18% from 2024 to 2030.

3. IRB Infrastructure Developers

Overview:

IRB Infrastructure Developers is a leading player in the roads and highways sector, specializing in Build-Operate-Transfer (BOT) projects.

Headquarters:

Mumbai, Maharashtra

Services:

- Road and highway construction

- BOT projects

- Real estate development

Stock Potential:

IRB’s expertise in road construction, along with a healthy order book and government focus on improving national highways, ensures steady growth.

Market Price (As of June 2024):

₹300 per share

Cost Profit Potential:

With its strong project pipeline and execution capabilities, IRB could deliver annual returns of 10-13% over the next six years.

4. NTPC Limited

Overview:

NTPC is India’s largest energy conglomerate, primarily engaged in the generation and sale of electricity.

Headquarters:

New Delhi, Delhi

Services:

- Power generation

- Renewable energy projects

- Energy trading

Stock Potential:

NTPC’s expansion into renewable energy and modernization of thermal power plants make it a balanced growth investment.

Market Price (As of June 2024):

₹200 per share

Cost Profit Potential:

As India transitions towards cleaner energy, NTPC could provide annual returns of 8-10% driven by its diversified energy portfolio.

5. GMR Infrastructure

Overview:

GMR Infrastructure is involved in airport development and operations, urban infrastructure, and highways.

Headquarters:

New Delhi, Delhi

Services:

- Airport development and management

- Urban infrastructure projects

- Energy sector investments

Stock Potential:

GMR’s focus on airport infrastructure, driven by rising air travel, positions it well for long-term growth.

Market Price (As of June 2024):

₹45 per share

Cost Profit Potential:

With increasing air traffic and ongoing airport projects, GMR could offer annual returns of 12-15% from 2024 to 2030.

6. JMC Projects (India) Limited

Overview:

JMC Projects, a subsidiary of Kalpataru Power Transmission, is engaged in civil construction and infrastructure development.

Headquarters:

Mumbai, Maharashtra

Services:

- Civil construction

- Industrial construction

- Water management projects

Stock Potential:

JMC’s diversified project base and strong execution track record make it a promising investment in the infrastructure sector.

Market Price (As of June 2024):

₹150 per share

7. GAIL (India) Limited

Overview:

GAIL is the largest state-owned natural gas processing and distribution company in India.

Headquarters:

New Delhi, Delhi

Services:

- Natural gas processing and distribution

- Petrochemicals

- Liquid hydrocarbons

Stock Potential:

Expansion in natural gas infrastructure and increasing domestic gas production are key growth drivers.

Market Price (As of June 2024):

₹145 per share

Cost Profit Potential:

Annual returns of 8-10% from 2024 to 2030.

8. Bharat Heavy Electricals Limited (BHEL)

Overview:

BHEL is an engineering and manufacturing company involved in the energy and infrastructure sectors.

Headquarters:

New Delhi, Delhi

Services:

- Power generation equipment

- Transmission systems

- Renewable energy

Stock Potential:

Modernization efforts and a push towards renewable energy projects provide a balanced growth outlook.

Market Price (As of June 2024):

₹65 per share

Cost Profit Potential:

Annual returns of 7-9% driven by modernization and diversification efforts.

9. Engineers India Limited (EIL)

Overview:

EIL provides engineering consultancy and EPC (Engineering, Procurement, and Construction) services.

Headquarters:

New Delhi, Delhi

Services:

- Engineering consultancy

- EPC projects

- Project management

Stock Potential:

Strong order book, government contracts, and diversification into new sectors ensure steady growth.

Market Price (As of June 2024):

₹85 per share

Cost Profit Potential:

Annual returns of 8-11% over the next six years.

10. Ashoka Buildcon Limited

Overview:

Ashoka Buildcon is engaged in the construction and maintenance of roads and highways.

Headquarters:

Nashik, Maharashtra

Services:

- Road construction

- Power transmission and distribution

- Real estate development

Stock Potential:

Extensive project portfolio and strong execution capabilities make Ashoka Buildcon a solid investment.

Market Price (As of June 2024):

₹130 per share

Cost Profit Potential:

Annual returns of 10-12% from 2024 to 2030.

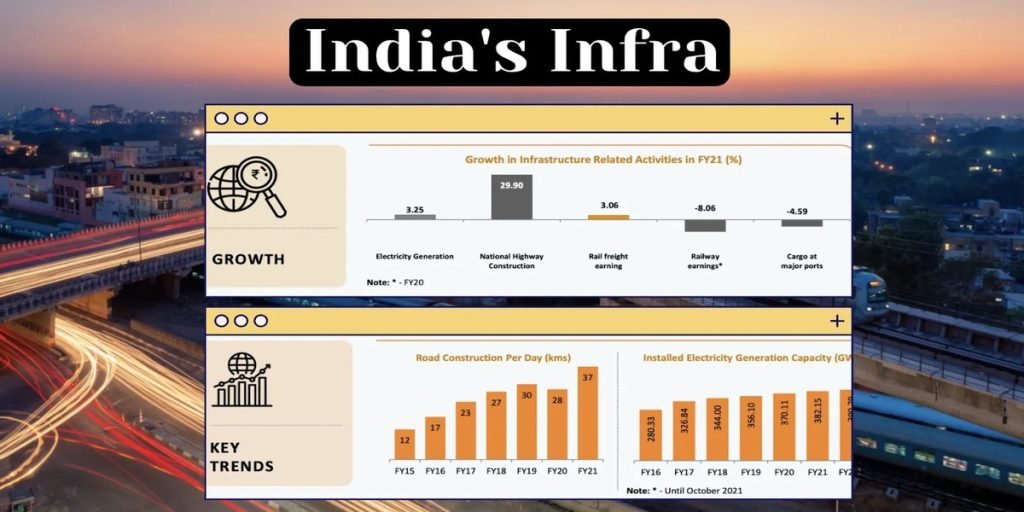

Understand the Infra stocks:

India’s infrastructure sector is on the cusp of major growth, fueled by government initiatives, urbanization, and investments in transportation, energy, and smart cities. This presents an enticing opportunity for investors to tap into the potential of infrastructure stocks.

The Bottom Line:

India’s infrastructure sector is set to witness significant growth, driven by substantial government investments and increasing private sector participation. Stocks of companies like Larsen & Toubro, Adani Ports, IRB Infrastructure Developers, NTPC, GMR Infrastructure, and JMC Projects are poised to benefit from this growth. Investors looking for long-term gains should consider these stocks, keeping in mind the potential risks and the importance of a diversified portfolio.